California Ftb Tax Brackets 2020 . how to figure tax using the 2020 california tax rate schedules example: Chris and pat smith are filing a joint tax return using. the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. 2020 california tax table to find your tax: Do not use the calculator for 540 2ez or prior tax years. california individual tax rates, deductions and exemptions for 2020. .” to find the range. tax calculator is for 2023 tax year only. • read down the column labeled “if your taxable income is. 2020 federal filing requirements for most taxpayers filing status gross income at least: how to figure tax using the 2020 california tax rate schedules example: Chris and pat smith are filing a joint tax return using. california's income tax brackets were last changed two years ago for tax year 2021, and the tax rates were previously changed in. Single under 65.$12,400 65 or.

from www.uslegalforms.com

how to figure tax using the 2020 california tax rate schedules example: Chris and pat smith are filing a joint tax return using. how to figure tax using the 2020 california tax rate schedules example: 2020 federal filing requirements for most taxpayers filing status gross income at least: .” to find the range. the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. tax calculator is for 2023 tax year only. california individual tax rates, deductions and exemptions for 2020. california's income tax brackets were last changed two years ago for tax year 2021, and the tax rates were previously changed in. • read down the column labeled “if your taxable income is.

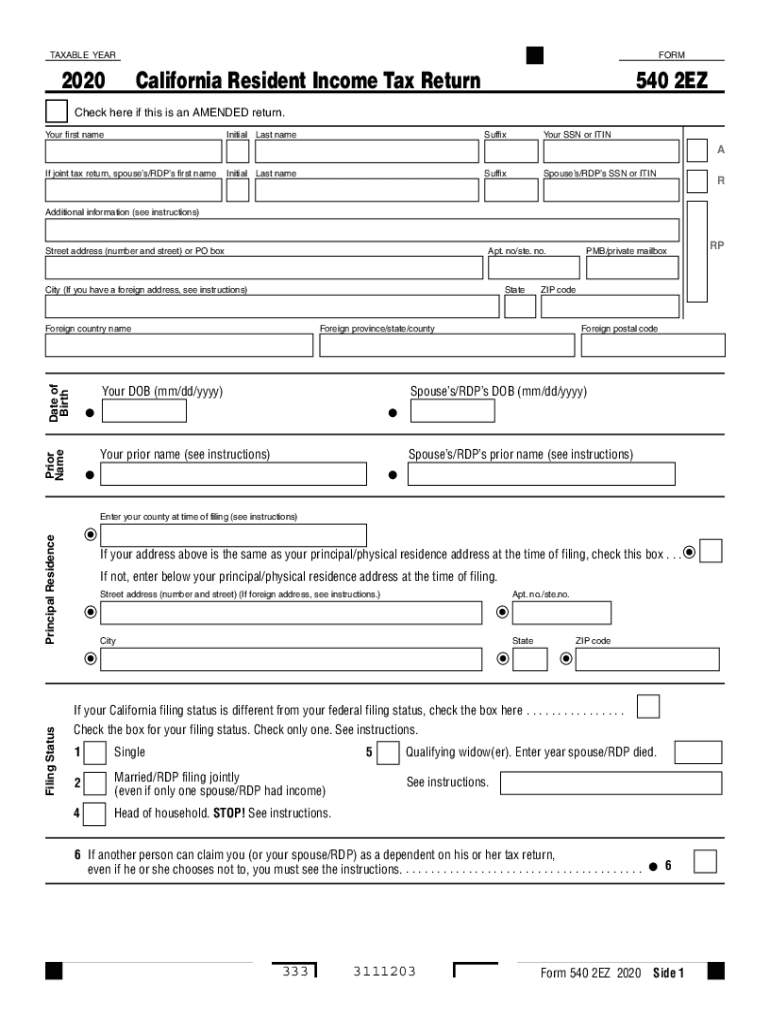

CA FTB 540 2EZ 2020 Fill out Tax Template Online US Legal Forms

California Ftb Tax Brackets 2020 how to figure tax using the 2020 california tax rate schedules example: Do not use the calculator for 540 2ez or prior tax years. california's income tax brackets were last changed two years ago for tax year 2021, and the tax rates were previously changed in. Single under 65.$12,400 65 or. 2020 california tax table to find your tax: how to figure tax using the 2020 california tax rate schedules example: how to figure tax using the 2020 california tax rate schedules example: • read down the column labeled “if your taxable income is. Chris and pat smith are filing a joint tax return using. Chris and pat smith are filing a joint tax return using. the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. .” to find the range. california individual tax rates, deductions and exemptions for 2020. 2020 federal filing requirements for most taxpayers filing status gross income at least: tax calculator is for 2023 tax year only.

From riloonweb.weebly.com

2020 tax brackets california riloonweb California Ftb Tax Brackets 2020 california's income tax brackets were last changed two years ago for tax year 2021, and the tax rates were previously changed in. Chris and pat smith are filing a joint tax return using. the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. Do not use the calculator for. California Ftb Tax Brackets 2020.

From bikerbookkeeper.com

2020 Tax Brackets M Hernandez Taxes Bookkeeping California Ftb Tax Brackets 2020 2020 california tax table to find your tax: Do not use the calculator for 540 2ez or prior tax years. 2020 federal filing requirements for most taxpayers filing status gross income at least: Chris and pat smith are filing a joint tax return using. .” to find the range. Single under 65.$12,400 65 or. how to figure. California Ftb Tax Brackets 2020.

From andmoretros.weebly.com

2020 california tax brackets andmoreTros California Ftb Tax Brackets 2020 Single under 65.$12,400 65 or. tax calculator is for 2023 tax year only. california individual tax rates, deductions and exemptions for 2020. how to figure tax using the 2020 california tax rate schedules example: Chris and pat smith are filing a joint tax return using. Do not use the calculator for 540 2ez or prior tax years.. California Ftb Tax Brackets 2020.

From www.uslegalforms.com

CA FTB 3519 2020 Fill out Tax Template Online US Legal Forms California Ftb Tax Brackets 2020 .” to find the range. california individual tax rates, deductions and exemptions for 2020. • read down the column labeled “if your taxable income is. Single under 65.$12,400 65 or. 2020 california tax table to find your tax: how to figure tax using the 2020 california tax rate schedules example: california's income tax brackets were last. California Ftb Tax Brackets 2020.

From www.uslegalforms.com

CA FTB 109 20202022 Fill out Tax Template Online US Legal Forms California Ftb Tax Brackets 2020 tax calculator is for 2023 tax year only. .” to find the range. • read down the column labeled “if your taxable income is. 2020 federal filing requirements for most taxpayers filing status gross income at least: the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. . California Ftb Tax Brackets 2020.

From ftb.ca.gov

2020 Personal Tax Booklet California Forms & Instructions 540 California Ftb Tax Brackets 2020 california individual tax rates, deductions and exemptions for 2020. 2020 federal filing requirements for most taxpayers filing status gross income at least: how to figure tax using the 2020 california tax rate schedules example: 2020 california tax table to find your tax: .” to find the range. Chris and pat smith are filing a joint tax. California Ftb Tax Brackets 2020.

From www.uslegalforms.com

CA FTB Tax Table 20202022 Fill and Sign Printable Template Online California Ftb Tax Brackets 2020 Do not use the calculator for 540 2ez or prior tax years. Single under 65.$12,400 65 or. tax calculator is for 2023 tax year only. Chris and pat smith are filing a joint tax return using. how to figure tax using the 2020 california tax rate schedules example: how to figure tax using the 2020 california tax. California Ftb Tax Brackets 2020.

From www.uslegalforms.com

CA FTB 592F 2020 Fill out Tax Template Online US Legal Forms California Ftb Tax Brackets 2020 2020 federal filing requirements for most taxpayers filing status gross income at least: tax calculator is for 2023 tax year only. california individual tax rates, deductions and exemptions for 2020. how to figure tax using the 2020 california tax rate schedules example: .” to find the range. 2020 california tax table to find your tax:. California Ftb Tax Brackets 2020.

From www.uslegalforms.com

CA FTB 540 2EZ 2020 Fill out Tax Template Online US Legal Forms California Ftb Tax Brackets 2020 california individual tax rates, deductions and exemptions for 2020. Chris and pat smith are filing a joint tax return using. .” to find the range. how to figure tax using the 2020 california tax rate schedules example: • read down the column labeled “if your taxable income is. 2020 california tax table to find your tax: . California Ftb Tax Brackets 2020.

From www.westernstatesfinancial.com

2021 State of CA Tax Brackets Western States Financial & Western California Ftb Tax Brackets 2020 • read down the column labeled “if your taxable income is. Single under 65.$12,400 65 or. california individual tax rates, deductions and exemptions for 2020. the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. california's income tax brackets were last changed two years ago for tax year. California Ftb Tax Brackets 2020.

From www.westernstatesfinancial.com

2020 State of CA Tax Brackets Western States Financial & Western California Ftb Tax Brackets 2020 how to figure tax using the 2020 california tax rate schedules example: 2020 federal filing requirements for most taxpayers filing status gross income at least: how to figure tax using the 2020 california tax rate schedules example: california's income tax brackets were last changed two years ago for tax year 2021, and the tax rates were. California Ftb Tax Brackets 2020.

From pasivinc.netlify.app

California 2020 Tax Brackets California Ftb Tax Brackets 2020 how to figure tax using the 2020 california tax rate schedules example: Single under 65.$12,400 65 or. 2020 california tax table to find your tax: 2020 federal filing requirements for most taxpayers filing status gross income at least: california's income tax brackets were last changed two years ago for tax year 2021, and the tax rates. California Ftb Tax Brackets 2020.

From www.westerncpe.com

Know Your California Tax Brackets Western CPE California Ftb Tax Brackets 2020 Chris and pat smith are filing a joint tax return using. how to figure tax using the 2020 california tax rate schedules example: tax calculator is for 2023 tax year only. california's income tax brackets were last changed two years ago for tax year 2021, and the tax rates were previously changed in. 2020 california tax. California Ftb Tax Brackets 2020.

From www.uslegalforms.com

CA FTB 100W 20202022 Fill out Tax Template Online US Legal Forms California Ftb Tax Brackets 2020 Single under 65.$12,400 65 or. Chris and pat smith are filing a joint tax return using. the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. how to figure tax using the 2020 california tax rate schedules example: california's income tax brackets were last changed two years ago. California Ftb Tax Brackets 2020.

From tewscross.weebly.com

California tax brackets 2020 tewscross California Ftb Tax Brackets 2020 how to figure tax using the 2020 california tax rate schedules example: 2020 california tax table to find your tax: tax calculator is for 2023 tax year only. Single under 65.$12,400 65 or. 2020 federal filing requirements for most taxpayers filing status gross income at least: .” to find the range. how to figure tax. California Ftb Tax Brackets 2020.

From taxfoundation.org

2020 State Individual Tax Rates and Brackets Tax Foundation California Ftb Tax Brackets 2020 2020 california tax table to find your tax: how to figure tax using the 2020 california tax rate schedules example: california individual tax rates, deductions and exemptions for 2020. .” to find the range. the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. 2020 federal. California Ftb Tax Brackets 2020.

From qustsmallbusiness.weebly.com

2020 federal tax brackets qustsmallbusiness California Ftb Tax Brackets 2020 2020 federal filing requirements for most taxpayers filing status gross income at least: 2020 california tax table to find your tax: the income tax rates and personal allowances in california are updated annually with new tax tables published for resident. Chris and pat smith are filing a joint tax return using. california individual tax rates, deductions. California Ftb Tax Brackets 2020.

From blog.finapress.com

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress California Ftb Tax Brackets 2020 how to figure tax using the 2020 california tax rate schedules example: tax calculator is for 2023 tax year only. 2020 california tax table to find your tax: • read down the column labeled “if your taxable income is. Chris and pat smith are filing a joint tax return using. Chris and pat smith are filing a. California Ftb Tax Brackets 2020.